Hiring and talent acquisition have massively transformed over the last couple of years. While 2021 witnessed the effects of the Great Resignation, scarcity of skilled candidates, and other hiring challenges, 2022 has been all about attracting, nurturing, and retaining the best-skilled talent by providing them with all the necessary tools and resources to excel.

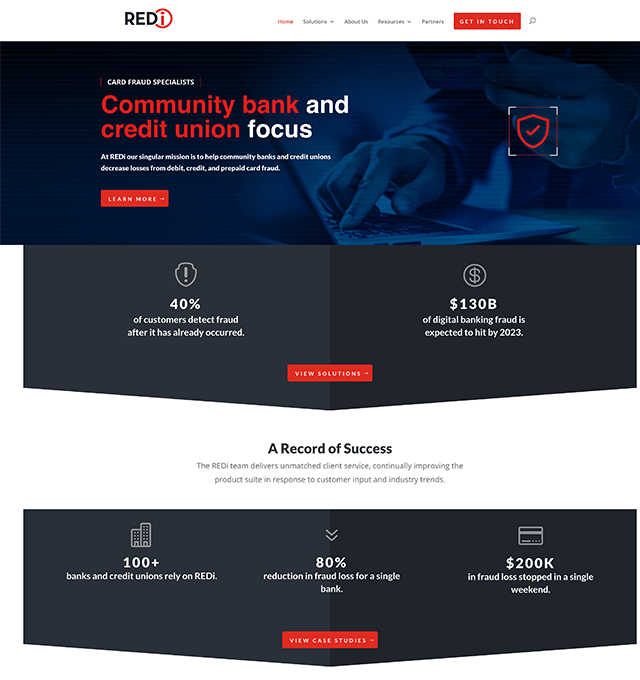

But hiring challenges faced by talent teams in almost all industries are far from over. In 2021, the financial industry, for example, had the lowest unemployment rate of any sector in the U.S. at just 3.2%. This means that almost every organization was faced with issues of hiring, retention, employee burnout, and inadequate expertise in finance and accounting.

These challenges are surprisingly not new to the industry. Accounting and finance firms have long been concerned about not being able to find and attract talent with the appropriate skillset. In addition, advancement in technology in the last couple of years has led to employers looking for finance labor not just to crunch numbers but also someone with people skills and the ability to adapt to change easily.

Such challenges can come in the way of achieving business goals. But we might have a solution that could fix this problem within weeks! Here are four reasons why you should outsource your finance and accounting talent today to help alleviate your hiring challenges.

#1 Save Money By Hiring a Part-Timer

An accountant’s job may involve expense reporting, statement reconciliation, payroll management, and other financial activities carried out once on a weekly, monthly, or yearly basis. If you are a small business owner, it is an unrealistic expense to hire a full-time accountant. You’ll only need their services some of the time, but you’ll be paying them for all the times you don’t need their services too. Also, when you hire an employee, it’s not just their salary that you need to consider. You also need to consider health insurance, local taxes, and other employee benefits.

To save on these additional expenses, you can outsource your accounting jobs. When you outsource for a specific role, you hire labor on a contract or project basis and pay them for the time they actually work for you. This way, you can save yourself the expenses of hiring a full-time employee.

#2 Access a Broader Pool of Experts

Accounting and finance roles are skill-based job roles that require candidates to have specific expertise in and knowledge of bookkeeping, preparing quarterly or yearly budget forecasts, collecting taxes and preparing tax returns, managing balance sheets and profit/loss statements, and much more. In such a high-stake scenario, hiring just anyone with a degree in finance doesn’t cut the deal. Organizations often look for professionals and experts for such roles.

That’s why hiring the right candidate may take much longer for accountants than for other roles and often in-house recruiters don’t have enough bandwidth to do so. Here is when outsourcing such job roles becomes essential for small businesses. Often outsourcing agencies, such as GoGenies, have great expertise in hiring highly-skilled talent for niche roles in a fraction of time. They also have a team of recruiters who may have experience in hiring for such roles in the past. Often, such recruiters have a pool of expert talent ready to reach out to and interview.

In addition to that, part-time talent typically has experience in working for several different companies with different challenges, expectations, and resources rather than just a handful. This makes part-time accountants much more capable of doing a great job than someone with experience in only a certain work environment.

#3 Avoid the High Cost of Employee Turnover

Another issue that could come from hiring a full-time accountant is dealing with employee turnover. It’s normal for businesses to cycle through employees. However, the process of finding, hiring, and training new employees can be incredibly tedious, disruptive, and costly for businesses. It can take months to find an individual who is well-equipped to work in your organization.

If you choose to outsource your accountant, you simply have to find an accounting outsourcing service and let them know your requirements. They will handle the dirty work of finding the right fit and save you the hassle of searching, posting job ads, selecting and rejecting underqualified applications, and interviewing candidates that don’t quite fit the job description. You’ll only have to meet the ones that have reached the final stage of the interview and give your approval to the best fit.

#4 Focus Your Time on Your Business, Not Hiring

We already established above that outsourcing accounting projects can save you time by no longer having to deal with employee turnover and its effects. However, outsourcing accounting talent can save you time in other ways as well.

As a small business owner, you may often have to take on multiple projects from different departments while looking for the right talent. But when you outsource and cut down on the time to hire, you can hit your deadlines, and your other projects can finish on time without making you or others feel overburdened with work.

When you choose to have an HR partner to hire for you, you can use that hiring time to focus on your business. While the outsourcing company takes care of finding the most suitable accountants for you, you can also start working on their paperwork, onboarding process, and other administrative tasks can finish smoothly before or on time.

Conclusion

It can be tough to find highly skilled talent in a candidate-driven market. Often the answer can be outsourcing the work instead of hiring a full-timer. Outsourcing accounting talent can save you time and money while not disrupting your business. It also allows you to work with some of the most qualified individuals around the world that you wouldn’t normally be able to interact with. To find the best accountants for your business, visit the GoGenies Accounting page.